lincoln ne sales tax rate 2018

This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55 055.

2022 Nebraska Legislative Candidates Zulkoski Weber

Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250.

. The latest sales tax rate for Lincoln County NE. The Nebraska state sales tax rate is currently. 2019 tax increment financing report for the city of lincoln in march of 2018 governor ricketts signed into law an amendment to the nebraska community development law.

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. The Lincoln Nebraska general sales tax rate is 55. Lincoln Sales Tax Rates for 2022.

35 rows Sales and Use Tax Rates Effective October 1 2018 Through March 31 2019 Listed below by county are the total 475 State rate plus applicable local rates sales. An alternative sales tax rate of 1075 applies in the tax region Lincoln which appertains to zip code 72744. Gavin Newsom will propose a temporary tax cut for.

The December 2020 total local sales tax rate was also 7250. This is the total of state and county sales tax rates. The State of Nebraska sets a tax rate limit of 50 cents for municipalities which includes 45.

This rate includes any state county city and local sales taxes. Beutler Says Lamm Fails to Understand Sales Tax Notification Process October 11 2018 Sales and Use Tax Information Lincolns City sales and use tax rate increase In April 2015 Lincoln. The County sales tax rate is.

The Nebraska sales tax rate is currently. Fund 2018-2019 Tax Rate 2019-2020 Tax Rate General 020941 020981 Library 003733 003756. 2020 rates included for use while preparing your income tax deduction.

The 2018 United States Supreme Court decision in. The Lincoln County sales tax rate is. Notification to Permitholders of Changes in Local Sales and Use Tax Rates.

From 55 to 725 Every 2018 Q3 combined rates mentioned above are the results of Nebraska state rate 55 the Lincoln tax rate. A bill lr11ca seeking a 2022 vote of the people on a constitutional amendment to replace the states income. Lincoln ne sales tax rate 2018 Sunday June 5 2022 Edit.

The Lincoln sales tax rate is. 025 lower than the maximum sales tax in NE The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. The nebraska state sales and use tax rate is 55 055.

Did South Dakota v. There is no applicable county tax or. For Businesses Nebraska Sales and Use Tax The Nebraska state sales and use tax rate is 55 055.

The Lincoln Arkansas sales tax rate of 775 applies in the zip code 72744. Lincoln in Nebraska has a tax rate of 725 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Lincoln totaling.

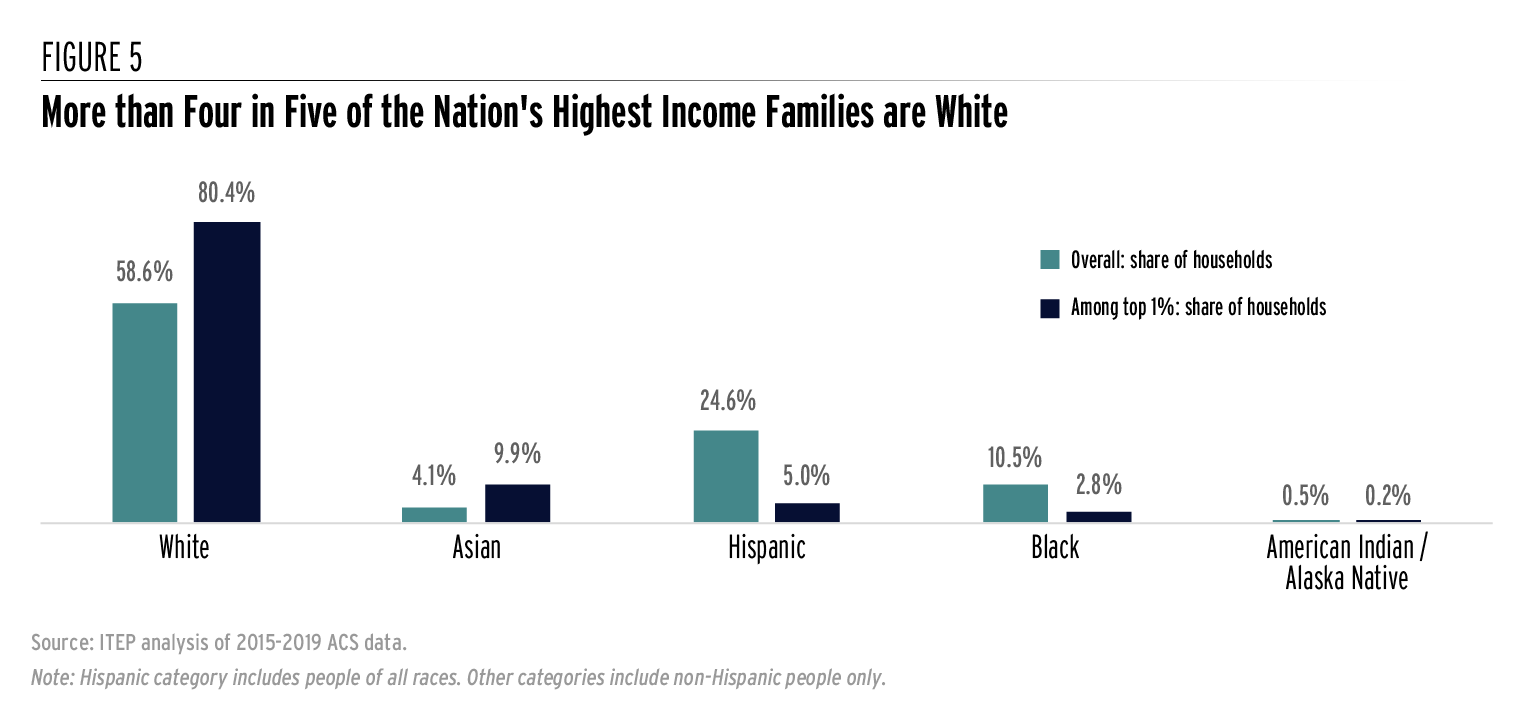

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Corporate Tax In The United States Wikipedia

Advancing Racial Equity With State Tax Policy Center On Budget And Policy Priorities

New Toyota Tacoma For Sale In Lincoln Ne

Where Are The 32 Highest Property Tax Rates In Ohio Cleveland Com

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Nebraska Sales And Use Tax Nebraska Department Of Revenue

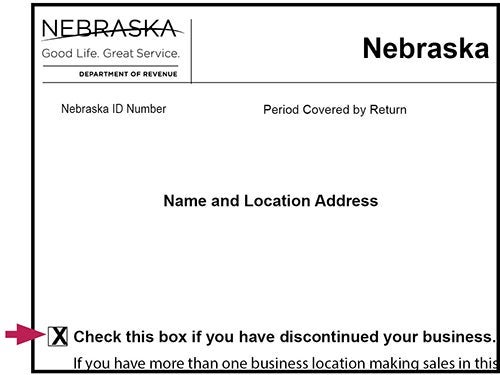

Closing Your Business In Nebraska Nebraska Department Of Revenue

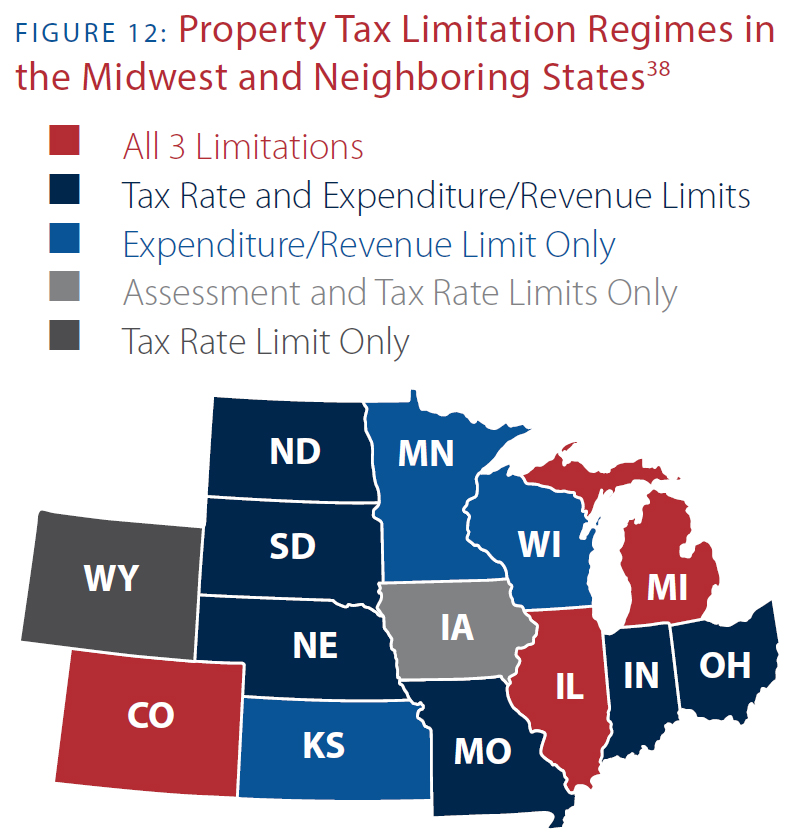

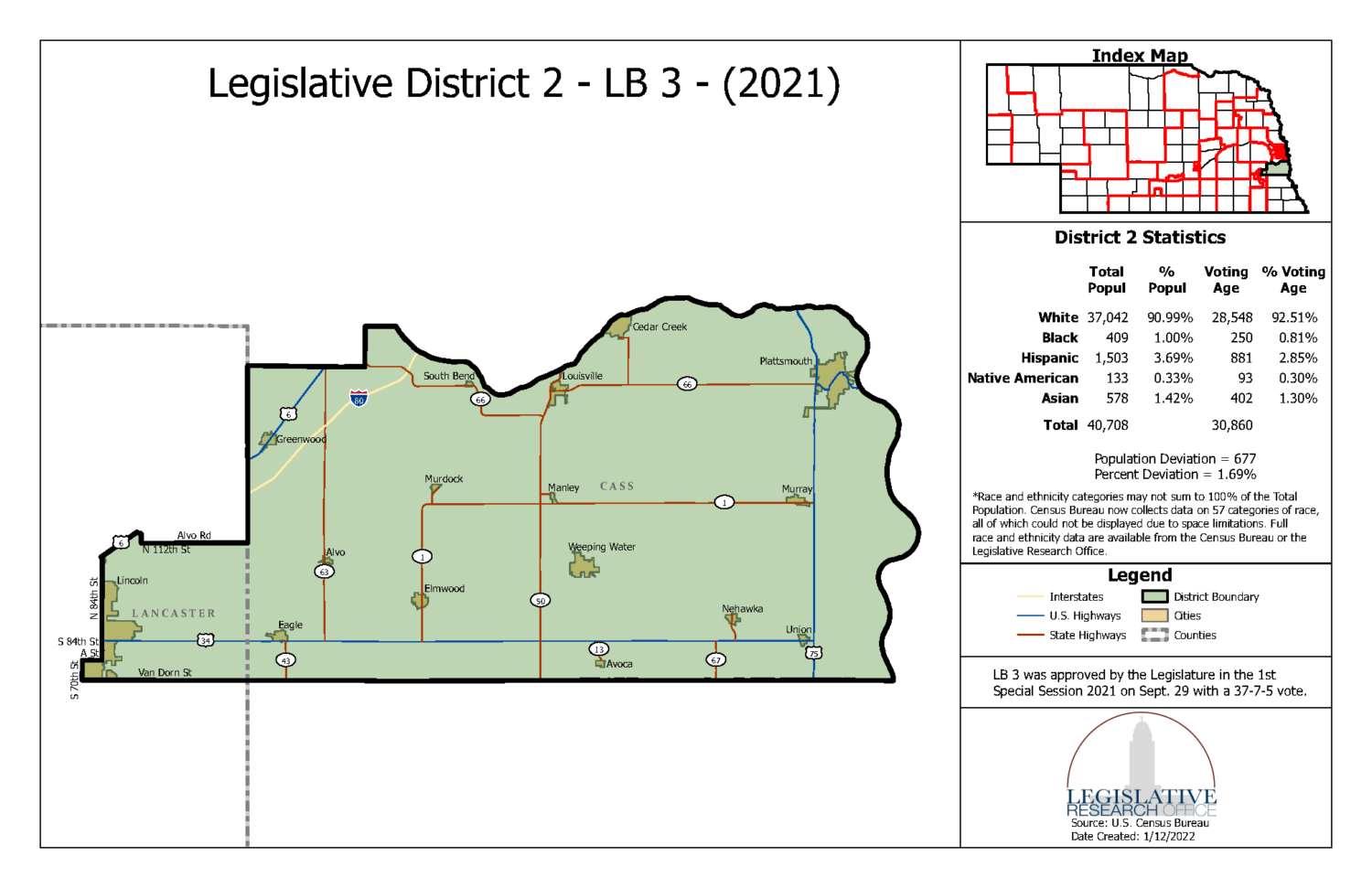

Taxes And Spending In Nebraska

Used Honda Civic For Sale In Lincoln Ne Cargurus

Used Cars Suvs Trucks For Sale In Lincoln Ne Anderson Ford Anderson Mazda Of Lincoln

Faqs Sarpy County Ne Civicengage

2020 Nebraska Property Tax Issues Agricultural Economics

Wyoming Income Tax Calculator Smartasset

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger